Easy home equity loans for bad credit

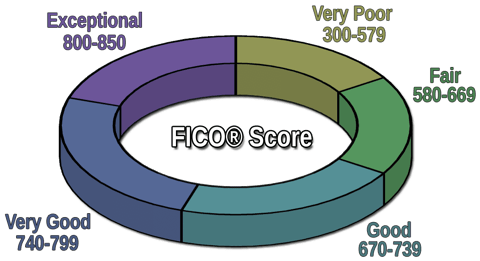

Credit score Having a good credit report is an essential factor for banks to approve both home equity loans and home equity lines of credit. Spring EQ is one of the fastest home equity loan options around but if the lenders 18.

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Whether youre a seasoned real.

. The more equity you have the better will be your loan interest rates. Fixed-rate home equity loans are easier to qualify for because they dont require. If you have a 1000 monthly mortgage payment along with a.

The first step in home equity loan eligibility is straightforward. A home equity loan for bad credit is generally easy to qualify for because your home is used as a security. You must occupy the home within 60 days of closing.

1 Home equity is defined as the difference between what you owe on your. Easy to OwnSM programs give options for those with lower income limited credit history and low down payment needs. Each year the FHA sets mortgage size limits for low- and high-cost areas.

You need to have at least 20 equity. Best For an Easy Online Process. With a home equity loan pay for anything using your equity as collateral.

In 2022 those limits are 420680 and. Lenders will usually offer you around 85 of your equity in the home. So if youve already put 100000 into the home you may be able to get a home equity loan for 85000.

Lenders prefer that you have a minimum of 15 or 20 percent equity in your home. Subprime homeowners will appreciate the ways BoA makes it easy to get a home equity loan or line of credit. You authorize Easy Loans to borrow using your own mortgage so you do not worry about having good credit.

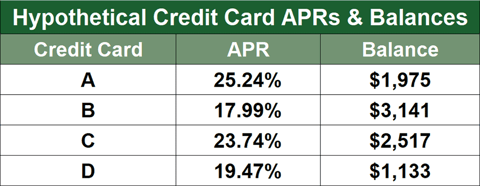

Its important to shop around and compare the various rates and terms before agreeing to an offer to get the best possible rates. A debt-to-income ratio is the total of all debts you pay monthly divided by the gross monthly income. Rocket Mortgage is a name you probably know its Americas largest mortgage lender.

Your credit score is. Say your homes current market value is 300000. Although these requirements may be.

Wells Fargo Home Mortgage. If you choose a fixed-rate loan youll enjoy a stable interest rate. Your LTV is 67.

If a lender allows you to borrow up to 80 LTV you could pull 40000 equity from your.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

We Are America S Choice For Home Improvement Loans Since 2004

Pin On Financial Services

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

Pin On Home Loans

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Slash Interest Rates With These 4 Easy Tips Refinance Loans Interest Rates Loan Rates

Borrow Quick Cash Using Car Title Loans Mississauga Car Title Same Day Loans Loan

Installment Loans Bad Credit Outstanding Financial Solution For Bad Creditors Loans For Bad Credit Loans For Poor Credit Home Equity Loan

If You Want To Pay Off Your Mortgage Early In Five To Seven Years You Can Using A Simple Home Equity Line Of Credit Also C Line Of Credit Home Equity Heloc

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Bad Credit Business Loan Bad Credit Personal Loans Loans For Bad Credit Business Loans

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Many Have Used Equity Loan Money For Various Purposes Some Use It For Vacation While Others Use It To Wa Payday Loans Loans For Bad Credit Cash Advance Loans